Eat the rich

Global corporation tax will knock Big Tech down a peg by 2023

A total of 136 countries have agreed to raise their corporate tax rate to at least 15 percent in the next two years.

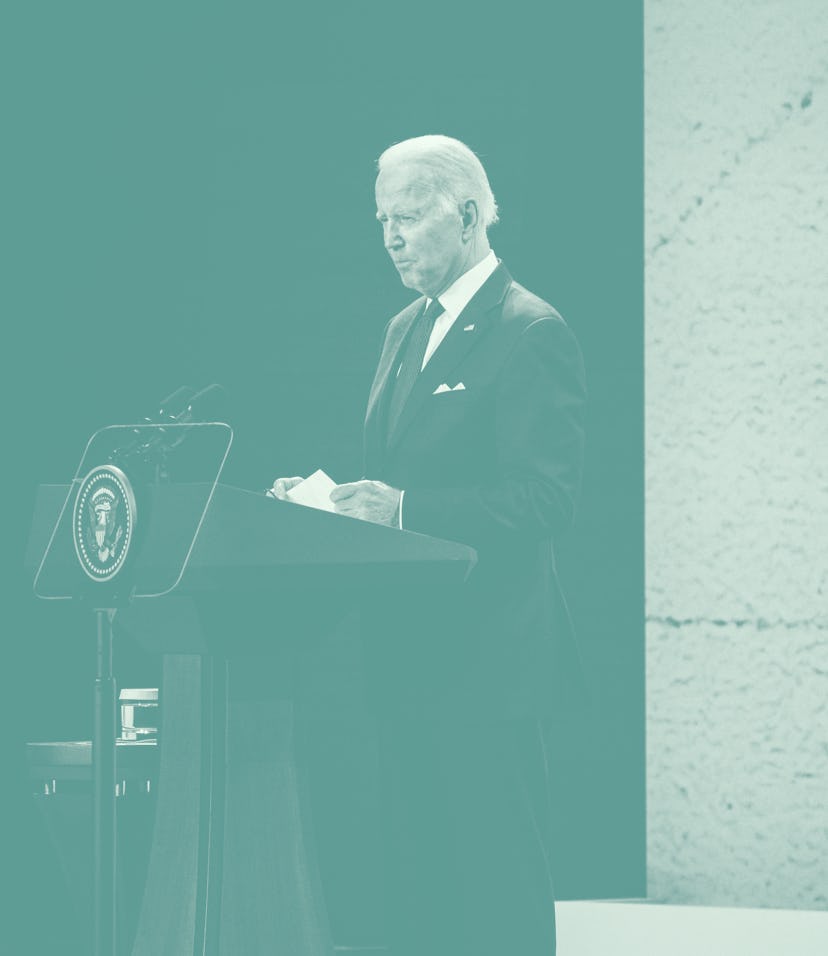

President Biden brought an intriguing, long-in-the-making pitch to this year’s G20 summit: A minimum tax for the world’s largest companies, mandated and enforced across the globe. All the world leaders in attendance agreed, and thus a global corporate tax was born. The tax deal, which will be enforced by 2023, sets a minimum tax rate of 15 percent for companies with revenues greater than €750 million — about $867 million. The global scope of the deal should make it much more difficult for corporations to flee the country in search of more lenient taxation laws.

“This reform will make our international tax system fairer and work better in a digitalized and globalized world economy,” Mathis Cormann, Secretary-General of the Organisation for Economic Co-operation and Development (OECD) said by way of greeting at this year’s G20 Leaders’ Declaration.

The 15 percent minimum has actually been agreed upon by far more governments than just those 20 meeting at the summit; a total of 136 countries and jurisdictions will enforce the law. Those territories represent a whopping 94 percent of global GDP.

It’s about time — The minimum corporate tax will bring in around $150 billion in new revenue globally, once it’s up and running. This extra cash is obviously a big motivator for those countries involved in the deal. Who would say no to a few extra billion in the budget?

For the public, though, there’s another huge incentive here: fairness. The world’s largest companies use loopholes to skip out on taxes year after year while the rest of us have a chunk of change taken out from every paycheck.

The ongoing pandemic has made this imbalance all the more apparent. Zoom, which brought in profits of more than $660 million last year, paid exactly zero dollars in taxes.

More luck overseas than at home — The OECD’s overwhelming agreement about this corporate tax minimum sends a strong message to the world’s largest businesses: Stop running away. It’s aimed straight at this one goal.

The agreement won’t change all that much for U.S.-based corporations, though, given that the federal corporate tax rate is already 21 percent. One of Biden’s campaign promises was to restore that rate to its pre-Trump 35 percent. Now the President has failed to convince lawmakers that even an increase to 28 percent would be worth the corporate blowback.

Notably, the global minimum tax rate will not increase the taxation rates for the world’s richest people — only for their companies. Crossing that bridge is another problem entirely.